- Date:

- 31 Oct 2025

Responsible body’s declaration

In accordance with the Financial Management Act 1994 (Vic), I am pleased to present the Portable Long Service Benefits Authority’s Annual Report for the year ending 30 June 2025.

Julius Roe

Chair, Governing Board

Portable Long Service Benefits Authority

Note on accessibility

We've provided as much of this Annual Report in HTML as practicable. Complex financial tables are provided in position in Word documents.

For accessibility assistance understanding this report, contact us via email(opens in a new window).

Who We Are

Delivering a quality Portable Long Service Benefits Scheme to protect the benefits of those who are entitled to them.

The Portable Long Service Benefits Authority (the Authority) is an independent statutory body established to oversee the Long Service Benefits Portability Act 2018 (Vic) (the Act). The Act, along with the Long Service Benefits Portability Regulations 2020 (Vic), creates a scheme allowing long service benefits to be transferable for Victorian workers in the community services, contract cleaning, and security industries.

The Portable Long Service Benefits Scheme (the Scheme) was established following an inquiry by the Victorian Parliament’s Economic, Education, Jobs and Skills Committee to allow workers to accrue long service benefits based on their total time in an industry, not with a single employer.

Since 2019, the Scheme has become one of Australia’s largest portable long service leave schemes. The Authority manages employer and worker registrations and oversees investment funds from employer levies for future entitlements.

The Authority is also charged with educating employers on their obligations under the Act. It uses its legislative powers to ensure proper worker registration, especially in the face of under registration, which remains one of the Authority’s key priorities.

Simultaneously, the Authority also educates workers about their rights, empowering them to inquire about their registration for the Scheme and manage their details.

Vision

Our vision is to deliver a quality Scheme to protect the benefits of those who are entitled to them.

Purpose

The Authority administers an effective Scheme through prudent, sustainable investment and supporting all stakeholders – including employers and workers alike – as well as educating and enforcing every stakeholder’s role and interest in the Scheme.

Our shared values

The Authority adheres to the Victorian Public Sector values, which underpin the behaviours that the government and community rightly expect of it. Acting consistently with these values strengthens the Authority’s capacity to operate effectively and achieve its objectives. These values are:

- Responsiveness - We are approachable and provide timely, useful and accurate information.

- Integrity - We have unbiased and honest interactions.

- Impartiality - We are firm and consistent in our application of the law.

- Accountability - We fulfil our objectives in a clear, transparent and responsible manner.

- Respect - We respect our stakeholders, each other and ourselves.

- Leadership - We seek to have a positive influence and to empower others.

- Human rights - We administer the law and deliver decisions, advice and policy that respect and support everyone’s human rights.

Chairperson and Chief Executive Officer / Registrar's Report

Outlining the Chair and Registrar's summary of 2024-25 achievements and vision for the future.

Delivering a quality Portable Long Service Benefits Scheme

On behalf of the Governing Board, we are pleased to present the Authority’s Annual Report for the financial year ended 30 June 2025.

The Authority continues to be responsible for the portable long service leave schemes that record and accrue long service entitlements for workers in the community services, contract cleaning and security industries. Now in the sixth year of operations, we are proud to report that at the end of the 2024-25 financial year, the Scheme has over 400,000 workers registered and holds investments of over $700 million to support worker entitlements on behalf of registered workers.

Consistent with the objectives set out in our 2023-26 Corporate Plan, during the current financial year, the Authority has continued to divide its focus across key strategic priorities. These included providing registered employers with improved guidance as well as support with technical functionality in the quarterly returns lodgement process. New targeted communications and engagement activities increased worker awareness of the Schemes and the understanding of individual worker entitlements. We have improved our website and guidance materials to enhance accessibility and overall engagement with the Schemes and the Authority.

In addition to these activities, the Authority is also aware of its role as a Regulator. During the financial year, we have not been afraid to exercise our compliance and enforcement powers against employers that fail to meet their legal obligations under the Long Service Benefits Portability Act 2018 and the Long Service Benefits Portability Regulations 2020. Our compliance and enforcement activities during the 2024-25 financial year have focused on employers that have failed to make payments of their invoiced contributions making it unfair for other compliant employers who are doing the right thing by their workers. Additionally, through various information channels, including intelligence from other areas of government as well as employer and worker representative bodies, the Authority has also continued to respond to deliberate non-registration by identified specific employers. Our investigation officers have conducted field operations across not just metropolitan Melbourne but also various parts of regional Victoria.

Critical to the success and financial sustainability of the Schemes is the investment of the assets that are collected and held in trust to support the portable long service entitlements of all workers. The Authority's funds are managed by the Victorian Funds Management Corporation (the Victorian Government's investment manager) and during the financial year, the investment performance of each of the Schemes has continued to exceed the targeted rate of return as well as other key financial measures.

Looking forward, as the Schemes mature towards the important seven year milestone upon which a large number of registered workers across all three Schemes will be entitled to access and take their portable long service entitlements, the Authority is working hard to ensure that underlying infrastructure (operational and technological) are ready to process the high volume of anticipated claims that will commence in 12 months time.

Finally, on behalf of the Governing Board, we would like to thank the Minister for Industrial Relations, the Department of Treasury and Finance, employer and worker representative bodies and all the staff within the Authority for their contributions over the past 12 months in making the 2024–25 financial year an important and successful one for the Authority.

Julius Roe

Chair, Governing Board

Joseph Yeung

Chief Executive Officer

Registrar

What We Do

The Authority has several key functions under the Act and is an independent statutory body.

Functions and Independence

Functions

The Authority has several key functions under the Act:

- Administering the Scheme in the covered industries.

- Making payments of long service benefits.

- Keeping registers of employers and workers.

- Resolving disputes regarding the timing of taking portable long service leave.

- Consulting with other industries that may be affected by decisions made under the LSBP Act concerning covered industries.

Independence

The Authority is an independent statutory body with an official seal. Under the LSBP Act, the Authority may sue and be sued and acquire, hold and dispose of property. The Authority employs staff who are Victorian Public Service employees.

Year In Review

Indicates the impressive growth of the Authority in the 2024-25 financial year.

| Registered Workers: 428,195 (20.31% increase from 2023-24 – 355,904) | Community Services: Contract Cleaning: Security: |

Registered Employers:

| Community Services: Contract Cleaning: Security: |

| Worker Breakdown | Community Services: Female: 203,840 Contract Cleaning: Female: 52,429 Security: Female: 5,346 |

| Community Engagement | Outbound calls: 15,332 Website visits: 267,398 eNewsletter: Social Media Engagement: Facebook: LinkedIn: |

| Scheme Assets | $773.5m (41.5% increase) |

| Reimbursements to employers | $16.2m (55.9% increase) |

Who Are We

The Authority's governance and organisational structure.

Governance and organisational structure

Effective governance is pivotal for the Authority to fulfil its primary objectives for the benefit of all stakeholders.

Governing arrangements

The Authority follows necessary procedures and adheres to monitoring systems to ensure it performs all its duties and functions to the required standard and in accordance with its legal obligations.

Minister

Jaclyn Symes

Minister for Industrial Relations

Tim Pallas MP

Minister for Industrial Relations (until December 2024)

Board

Chair

Julius Roe

Deputy Chair

Claire Filson

Board Members

Tim Piper AM

Rachaell Saunders

Juantia Pope

Lloyd Williams

Nicholas Richardson

Elisa Brophy* (until September 2024)

Julie Warren** (until April 2024)

Leon Wiegard*** (until May 2025)

Joseph Yeung

Governing Board Member/Registrar

Audit and Risk Committee Members

Chair

Claire Filson

Members

Rachaell Saunders

Stephen Brown (from 1 June 2025)

Independent member

Leon Wiegard*** (until May 2025)

Peter Wyatt**** (until March 2025)

Independent member

* Elisa Brophy resigned from the Governing Board and the Audit and Risk Committee on 20 September 2024.

** Julie Warren resigned from the Governing Board at the conclusion of her term on 7 April 2025.

*** Leon Wiegard resigned from the Governing Board and the Audit and Risk Committee on 26 May 2025.

**** Peter Wyatt resigned from the Audit and Risk Committee on 27 March 2025.

Our Board and Committees

The Portable Long Service Authority Board and Committees

The Authority is overseen by a Governing Board appointed by the Minister for Industrial Relations. This Board includes individuals with a range of expertise, qualifications and experience, representing employers and workers in the three covered industries – community services, contract cleaning and security.

Board members adhere to the standards of the Code of Conduct for Directors of Victorian Public Entities 2024 and the Public Administration Act 2004 (Vic).

As mandated by s38 of the LSBP Act, the Governing Board:

- Sets the levy to be paid by employers and contract workers

- Manages the Authority’s governance, strategic planning and risk management

- Advises the Minister on agreements for corresponding schemes across Australia

- Performs functions and exercises powers of the Authority as appropriate.

Our Governing Board

Julius Roe, Chair

Julius Roe’s career spans 40 years in industrial relations, including as a Fair Work Commissioner from 2010 to 2017.

He is a member of the Police Registration and Services Board. Since 2017, Julius has been working as a consultant, handling mediation in a diverse range of workplace disputes in the public and private sectors.

Julius has been a leader in vocational education and training policy, including various boards at both state and national level. He was National President of the Australian Manufacturing Workers Union from 2000-2010.

Claire Filson, Deputy Chair

Claire Filson has worked extensively in the financial services sector, with more than 20 years’ boardroom experience in superannuation and infrastructure businesses.

Before taking a break to travel in 2010, Claire was a director on the Board of Emergency Services and State Superannuation, a 150,000-member public sector superannuation fund managing $15 billion.

Claire has a mix of skills spanning law, governance and risk management. Claire is currently Deputy Chair of Indigenous Land & Sea Corporation and a director of National Centre of Indigenous Excellence Limited. During the financial year, Claire was also a director of Greater Western Water and Chair of the Kingston City Council – Audit Committee.

Tim Piper AM, Member

Tim Piper is the Head of the Australian Industry Group’s Victorian branch, advocating for more than 12,000 businesses in Victoria and over 60,000 across Australia.

He has had significant engagement with government at all levels. He chairs the Industry Capability Network, is Deputy Chair of the Rail Industry Advisory Council and sits on several Ministerial Committees and government bodies.

A lawyer in private practice in Australia and the UK, Tim was previously Executive Director of the Australian Retailers Association in Victoria. Tim was appointed a Member of the Order of Australia (AM) in the Queen’s Birthday 2020 Honours List for significant service to industry and manufacturing, to skills training and to multicultural youth.

Rachaell Saunders, Member

Rachaell Saunders is founder and CEO of National Protective Services, a leading national security organisation that specialises in both protective services and electronic security. Having founded the organisation in 1988 Rachaell has an extensive career within the security industry.

Rachaell has various qualifications in marketing, international business, risk management, security and business. As CEO of National Protective Services, she sets the strategic direction for the business with a focus on operations, finance, human resources, sales and marketing.

RachaelI has been on the board of the Australian Security Industry Association Limited, the peak body for security employers for several years and is currently Vice President.

Juanita Pope, Member

Juanita Pope is CEO of the Victorian Council of Social Service (VCOSS), the peak body for social and community services in Victoria. A lawyer specialising in the not-forprofit sector, Juanita is a strong voice on social justice and has 20 years’ experience in not-for-profit governance and leadership.

Juanita previously worked for a decade at Justice Connect as Head of Not-for-profit Law and, before joining VCOSS, held the role of General Counsel and Company Secretary at climate advocacy charity, The Sunrise Project. Juanita has also practiced in corporate law. She holds degrees in Law (with honours) and Arts from the University of Melbourne

Lloyd Williams, Member

Lloyd Williams is the National Secretary of the Health Services Union (HSU), representing over 110,000 workers in health, aged care, and disability services.

With over 35 years in national and state union leadership, he leads the HSU’s strategic, financial, policy, and political direction. Lloyd is a skilled advocate for workforce and service delivery reform and has led industrial bargaining and Award reform in the health, care and support sectors.

Lloyd is a current Director of the ‘HumanAbility’ – Jobs and Skills Council and a member of the Commonwealth National Aged Care Advisory Council. Lloyd has previously served on numerous boards, including HESTA, IFM Investors Advisory Board and various commonwealth and state industry reform taskforce.

Nicholas Richardson, Member

Nicholas is National Coordinator for Property Services at United Workers Union. Nicholas’ responsibilities centre on working with the cleaners and security guards that the union covers. Nicholas currently sits on the Victorian Security Industry Advisory Council. He has been deeply involved in driving improvements in conditions for cleaners and security guards for the last 13 years.

Elisa Brophy, Member

During the financial year, Elisa Brophy was Senior Industrial Officer of the Health and Community Services Union (Health Services Union, Vic No. 2 Branch). She led the industrial team at the union, representing members working in disability and mental health.

Elisa holds a Bachelor of Arts/Laws degree and has extensive legal and advocacy experience. Prior to working at the union, she was a Senior Criminal Solicitor at the Victorian Aboriginal Legal Service and regularly appeared in the Magistrates’ Court across Victoria.

Julie Warren, Member

In addition to her work whilst on the Authority's Governing Board, Julie Warren is also on the Board of Victorian WorkCover Authority (WorkSafe Victoria) and the Migrant Workers Centre Inc. She has worked for more than 20 years with the National Union of Workers and was president of the union’s Victorian branch for 13 years. In that role, she has been part of a number of valuable changes in strategic direction.

Previously, Julie was the Senior Vice President of the Victorian Trades Hall Council and has considerable understanding of the issues and concerns that are relevant to contract industries.

Leon Wiegard, Member

During the financial year, Leon was the Assistant Branch Secretary of the Australian Services Union (ASU). The ASU cover workers across the community services sector. Leon worked at the ASU representing community sector workers for over 18 years. Leon has sat on a number of state government advisory committees including, out of home care, National Disability Insurance Scheme (NDIS) and mental health and has worked with members across many community sector industrial and policy matters and has sat on the Victorian Trades Hall Council executive.

Joseph Yeung, Non Voting Member

Joseph Yeung is an experienced government Senior Executive and was previously the Chief Financial Officer at the Department of Premier and Cabinet from 2017 to 2019.

Before joining the Victorian Government, Joseph was an Assistant Secretary in the Civil Justice and Corporate Services Division at the Commonwealth Attorney-General’s Department in Canberra. A chartered accountant and lawyer, Joseph is a Graduate of the Australian Institute of Company Directors and also holds an MBA (Executive).

As Registrar, Joseph is a non-voting member of the Governing Board. As Chief Executive Officer, Joseph is responsible for the day-to-day management of the Authority and its operations.

Table 1: Director attendance at Governing Board meetings

| Director | Eligible to attend | Attended |

| Julius Roe | 6 | 4 |

| Claire Filson | 6 | 4 |

| Tim Piper AM | 6 | 6 |

| Rachaell Saunders | 6 | 6 |

| Elisa Brophy | 1 | 0 |

| Juanita Pope | 6 | 6 |

| Julie Warren | 3 | 3 |

| Leon Wiegard | 5 | 5 |

| Lloyd Williams | 3 | 3 |

| Nicholas Richardson | 3 | 3 |

| Joseph Yeung | 6 | 6 |

Retiring Board Members

The Authority would like to acknowledge and thank Elisa Brophy (resigned on 20 September 2024), Julie Warren (resigned on 7 April 2025) and Leon Wiegard (resigned on 26 May 2025) for their contribution to the Authority’s Governing Board.

Audit and Risk Committee

The Audit and Risk Committee (ARC), established by the Governing Board under the Standing Directions for the Minister for Finance (Vic) (2018) and the FMA Act, provides individual assurance and advice on the Authority’s financial management, performance, compliance, and risk management.

Comprising four members, the Committee operates under a charter outlining its role and responsibilities in line with the Standing Directions and best practice corporate governance principles and practices.

The Authority would like to acknowledge and thank Peter Wyatt (resigned on 27 March 2025) for his contribution to the Authority's Audit and Risk Committee.

Audit and Risk Committee membership and roles

- Claire Filson, Deputy Governing Board Chair and ARC Chair

- Rachaell Saunders, Governing Board Member, ARC Member

- Elisa Brophy, Governing Board Member, ARC Member (from April to 20 September 2024)

- Leon Wiegard, Governing Board Member, ARC Member (from 26 May 2025)

- Peter Wyatt, ARC Independent Member (until 27 March 2025)

- Stephen Brown, ARC Independent Member (from 1 June 2025)

Stephen Brown, Independent Member

Audit and Risk Committee

The ARC’s independent member, Stephen Brown, has held senior positions in the banking and finance industry with KPMG, ANZ, Bendigo and Adelaide Bank, RSD Chartered Accountants and Rural Finance Corporation during his executive career. He has held various governance roles including being a director at Vision Super.

Stephen is currently Board Chair at North East Water and a director at VicWater and Bendigo Stadium Limited. He is also an independent Audit and Risk Committee member at City of Greater Bendigo and South Gippsland Water.

Having completed a Bachelor of Business (Accounting), Stephen is a registered Company Auditor, a Fellow of the Institute of Chartered Accountants of Australia and New Zealand, and a graduate of the Australian Institute of Company Directors.

The following table indicates committee member attendance at ARC meetings for the Authority.

Table 2: Attendance at ARC meetings

| Director | Eligible to attend | Attended |

| Claire Filson | 6 | 6 |

| Rachaell Saunders | 6 | 6 |

| Elisa Brophy | 2 | 0 |

| Leon Wiegard | 3 | 2 |

| Peter Wyatt | 5 | 4 |

| Stephen Brown | 1 | 1 |

Conflicts of Interest

The Authority’s Conflict of Interest policies for the Governing Board and employees outline obligations for managing conflicts of interest. These policies ensure a transparent and accountable process, aiding compliance with section 81 of the Public Administration Act 2004 (Vic) and section 45 of the LSBP Act regarding

pecuniary interests.

Internal Audit

The Authority has appointed AFS Associates as its internal auditors to execute a comprehensive risk-based strategic internal audit program. Audits undertaken this year focused on training and development, accounts payable, payroll and compliance with standing directions. All audit results and follow-up actions were reported to the ARC.

As the funds under investment grows and the Authority matures as a regulator, the Authority has also implemented a bespoke operational assurance audit program. Designed to supplement the traditional internal audit program, it focuses on bespoke operational assurance audits appropriate to our specific operating environment.

Occupational Health and Safety

The Authority is committed to providing and maintaining a healthy and safe working environment for staff and visitors in accordance with the Occupational Health and Safety Act 2004 (Vic) and associated regulations.

Occupational Health and Safety Committee

The Authority’s Occupational Health and Safety Committee, comprising management and health and safety representatives, meets every two months to discuss workplace health, safety, and wellbeing matters.

Legislation and Operating Environment

Legislative environment

Under the LSBP Act, the Authority manages the Scheme for covered employers and workers in Victoria’s community services, contract cleaning and security industries. Employers in these sectors must register themselves and their workers with the Authority via our online portal.

Each quarter, registered employers must submit a return detailing worker information, including workers’ service with that employer, and pay a levy. This levy funds future long service payments for covered workers.

The Scheme allows workers to accrue long service leave and take it with them if they change employers but stay in the same industry. Registered workers can check their balances or update their details online through the worker portal.

After at least seven years of service, workers can apply for their portable long service benefit, which varies slightly across the three sectors.

Our Business Units

The business units of the Portable Long Service Authority.

Overview

The Authority continues to expand its staffing profile to meet the demands of administering a growing Scheme.

Each of our business units – Customer Service; Finance and Claims; Legal, Governance and Enforcement; Facilities and Information Technology; Communications and Engagement; and People and Culture – have worked together collaboratively throughout the 2024-25 financial year.

Customer Service

The Customer Service business unit is responsible for the administration of the Scheme. This includes the Authority’s customer service contact centre, maintenance of the Authority’s employer and worker registers, onboarding employers and workers, missing service claims and direct worker registrations.

Finance and Claims

The Finance and Claims business unit is essential to our operations, with the Head of Finance holding specific responsibilities under the FMA Act. In 2024-25, the business unit was expanded to include a new Lodgements team that is responsible for the lodgement of quarterly returns.

Through performance monitoring, responsible budgeting and a robust investment strategy, the Finance and Claims business unit ensures the entitlements of registered workers are accurately recorded, managed effectively and paid in accordance with the requirements of the Scheme.

Legal, Governance and Enforcement

The Legal, Governance and Enforcement business unit supports the Authority and Governing Board in adhering to its legal, governance and compliance obligations under the LSBP Act and the regulatory environment of a statutory authority. It is also responsible for driving the Authority’s compliance and enforcement

activity. During the year, two new teams were established within the unit, one team is focused on employers’ compliance with their regulatory obligations under the Scheme. The second team is focused on investigating and taking appropriate and proportionate enforcement action against non-complying employers.

Facilities and Information Technology

The Facilities and Information Technology (IT) business unit supports the Authority’s operations by providing IT support, security, records and information management, and managing the external portal for employers and workers. The

business unit oversees technology infrastructure, registration systems and office leases, collaborating with business units to enhance systems for efficiency and effectiveness.

The Project Management Office team also sits within this business unit and is responsible for partnering with internal stakeholders to deliver on strategic priorities.

Communications and Engagement

The Communications and Engagement business unit raises awareness of the Scheme and the Authority through our website, advertising and email campaigns, events, social media, public relations and stakeholder engagement activities to ensure employers understand their obligations and workers understand their rights.

People and Culture

The People and Culture business unit fosters a safe and welcoming work environment to support staff growth and development. It empowers employees

to thrive, driving a positive culture and ensuring a robust performance management framework.

Workforce Data

The Authority’s policies and practices align with the Victorian Victorian Public Sector Commission's employment standards, adhering to VPS values.

These policies ensure fair treatment, career opportunities and the early resolution of workplace issues. The Authority also offers guidance and training to employees on avoiding conflicts of interest, managing offers of gifts and addressing misconduct.

The following table discloses the head count and full-time equivalent (FTE) of all Authority employees employed in the last full pay period in June 2025.

Table 3: Comparative workforce data

| Ongoing | Fixed Term and Casual | Total | ||||

| Head count | FTE | Head count | FTE | Head count | FTE | |

| Gender |

|

|

|

|

|

|

| Male | 18 | 18 | 4 | 4 | 22 | 22 |

| Female | 52 | 51.5 | 2 | 2 | 54 | 53.5 |

| Self-described | 1 | 1 | 0 | 0 | 1 | 1 |

| Age |

|

|

|

|

|

|

| Under 25 | 4 | 4 | 0 | 0 | 4 | 4 |

| 25-34 | 20 | 19.8 | 0 | 0 | 20 | 19.8 |

| 35-44 | 23 | 22.8 | 1 | 1 | 24 | 23.8 |

| 45-54 | 15 | 15 | 4 | 4 | 19 | 19 |

| 55-64 | 8 | 7.9 | 1 | 1 | 9 | 8.9 |

| 64+ | 1 | 1 | 0 | 0 | 1 | 1 |

| Classification |

|

|

|

|

|

|

| VPS2 | 8 | 8 | 0 | 0 | 8 | 8 |

| VPS3 | 18 | 17.7 | 1 | 1 | 19 | 18.7 |

| VPS4 | 22 | 22 | 0 | 0 | 22 | 22 |

| VPS5 | 16 | 16 | 3 | 3 | 19 | 19 |

| VPS6 | 4 | 3.8 | 1 | 1 | 5 | 4.8 |

| STS | 3 | 3 | 0 | 0 | 3 | 3 |

| Executive | 0 | 0 | 1 | 1 | 1 | 1 |

The following table discloses the annualised total salary for senior employees of the Authority, categorised by classification, with salary amounts reported as the full-time annualised salary.

Table 4: Annualised total salary for executives and other senior-non-executive staff*

| Executives | STS | |||

| Headcount | FTE | Headcount | FTE | |

| $160,000 - $179,999 | 0 | 0 | 0 | 0 |

| $180,000 - $239,999 | 0 | 0 | 2 | 2 |

| $240,000 - $259,999 | 0 | 0 | 1 | 1 |

| $260,000 + | 1 | 1 | 0 | 0 |

*Data reflects employees in their substantive positions

Delivering on Our Targets

The Authority's targets and performance measures.

2023-26 Corporate Plan

The Authority’s 2023-26 Corporate Plan sets out the Authority’s short - medium term priorities and key performance measures. These priorities focus the Authority to ensure that:

- Covered employers and workers are registered

- Service of workers is captured

- Outstanding levies are paid

- The Authority has a strong, intelligence-led and risk-based compliance and enforcement program

- The Authority is able to process a high volume of claims.

With key priorities directing the Authority’s actions to June 2026, the specific areas of strategic focus for the Authority as approved by the Governing Board are:

- Identify and engage with key stakeholders.

- Implementing our Compliance and Enforcement Framework.

- Evolve baseline infrastructure to better practice systems and processes across the Scheme.

During the 2024-25 financial year, the Authority successfully executed multiple areas of strategic focus, operating in a fiscally responsible manner while maintaining strong governance frameworks. This is reflected in the results detailed below, with the Authority exceeding and remaining on-track for 12 of the 12 targets set out in our 2023-26 Corporate Plan.

2026 Performance measures

The Authority has identified the following relevant key performance indicators to measure the progress of performance by 30 June 2026.

| Employers registered | 4,300 |

| Workers registered | 400,000 |

| Levies invoiced to the Authority within 60 days of the end of each reporting period | 90% |

| (Target) Funding Ration | 110% |

| VPS People Matter Survey participation rate | 85% |

| Completed compliance investigations within 12-month period | 80 |

| Implementation of Integrated IT infrastructure to be claims ready in 2026-27 | 100% |

| Successful enforcement court action | 2 |

| Engagement activities and publication of insights on covered sectors | 4 per annum |

*includes compliance activity and/outstanding debtor recovery activities

Leading the way with our national AusLeave peers

For the second consecutive year, the Authority hosted the national AusLeave conference. AusLeave provides an opportunity for the leaders of Australia’s nine state and territory-based portable long service authorities to discuss their joint goals for workers in various industries.

More than two million workers in industries ranging from building and construction, community services, contract cleaning and security are covered by Australia’s portable long service leave schemes.

The schemes, which fall under the banner of AusLeave, collectively manage more than $5 billion dollars held for the benefit of workers in the covered industries.

The AusLeave conference, which brought together the Chairs and Chief Executive Officers, was held on Thursday 20 and Friday 21 of March 2025.

The Authority also hosted online sessions involving various business units including finance, legal, communications and information technology.

The following state and territory authorities attended the conference:

- ACT Leave – Australian Capital Territory’s construction, contract cleaning, community services, security and services industries

- LeavePlus – Victoria’s construction industry

- Long Service Corporation - New South Wales construction and contract cleaning industries

- MyLeave – Western Australia’s construction industry

- NT Build – Northern Territory’s construction industry

- Portable Long Service Authority – Victoria’s community services, contract cleaning and security industries

- SA Portable Long Service Leave – South Australia’s construction and community services industries

- TasBuild – Tasmania’s construction industry

- QLeave – Queensland's building and construction, contract cleaning and community services industries

Identify and engage key stakeholders

| Achievements towards Performance Measures | Unit of Measure | 2026 Target | 2024-25 Actual | On-track |

| Quantity | ||||

| Employers Registered | Number | 4,300 | 3,847 | Yes |

| Workers Registered | Number | 400,000 | 428,195 | Yes |

| Engagement activities and publication of insights on covered sectors | Number | 4 per year | 6 | Yes |

Increasing stakeholder awareness and understanding of the Scheme, as well as employer compliance are central themes in the 2023-26 Corporate Plan. In 2024-25, the Authority met its performance measure for engagement activities and publication of insights on covered sectors. Communications and engagement are vital to the continued growth of the Scheme.

Our 2024-25 activities were informed by user and market research and insights drawn from a strategic project focusing on innovative analysis and methods to ensure covered employers are aware of and complying with their obligations under the Scheme, including through collaboration with government and peak bodies, utilisation of publicly available material and direct proactive engagement with potential employers.

The Authority participated in two major community services expos in Melbourne and Geelong. These expos focused on the disability sector, with more than 6,700 people attending. The Authority also engaged with government agencies, disability service providers and consumers. Our work continued to identify employers who should be registered with the Scheme and the under-registration of workers.

By hosting two national AusLeave conferences, the Authority reinforced its leadership position in the portable long service sector. Chairs and senior executives from the nine portable long service leave authorities attended to network and exchange information on operations and emerging industry developments.

In addition to expos and conferences, the Authority presented information on the Scheme at Victorian Law Week, held an event for our 5-year anniversary in Bendigo which was attended by local employers and delivered monthly online training sessions for employers on quarterly returns.

The Authority also engaged directly with employers and peak bodies to assist in the streamlining of our processes. One example is the simplified reporting of hours and ordinary pay in quarterly returns. This simplification was well-received by employers and peak bodies and enabled us to strengthen relationships with these external stakeholders.

Identifying under-registered employers and workers

The Authority is exploring innovative ways to ensure covered employers are aware of and complying with their obligations under the Scheme.

In one instance, we attended a promotional event for employers in the community services sector and met directly with community services employers and workers. After the event, we sent correspondence to employers who were not registered and appeared potentially covered by the Scheme.

We also recognise that, in order to ensure all employers and their workers are registered, there is a role for the Authority to play in ensuring employers and workers understand the Scheme’s coverage. To support this, we increased our educational guidance to the sectors, through the Authority's eNewsletter and the website, and in direct engagement with peak bodies. This has included, for example, guidance on coverage of security trainers, NDIS providers and room attendants. This communication and education activity will grow further in the next financial year.

One business engaged with in this way was a community services employer with over 420 workers performing covered work. This employer now understands their obligation, has applied for registration and is in the process of filing backdated quarterly returns and paying its levies. Many of the employer’s workers were not previously registered for the Scheme and will now be able to accrue portable long service entitlements.

We continue to engage with unregistered potential employers to ensure they understand their obligations under the Scheme so that all covered workers can access the portable long service benefits they are entitled to.

Ensuring more workers now know their rights

The Authority delivered a range of communication and engagement projects and activities during the 2024-25 financial year to educate workers about their rights under the Scheme.

The Authority’s website content was refreshed in October 2024 and a new site went live in March 2025. The new design saw content arranged in worker and employer streams, with the new menu structure and content significantly improving the user experience. Enhancements targeting workers also included a self-registration process and guidance materials explaining this process. An SMS campaign also targeted workers encouraging them to ensure contact details were up to date to enable them to receive the benefits they are entitled to.

A broad awareness campaign for workers was launched in February 2025. The message was: “If you work in community services, contract cleaning or the security industry, you may be eligible for portable long service leave. Find out if you are eligible by going to the PLSA website.”

The worker awareness campaign was followed by an employer obligation campaign in June 2025, calling on covered employers to register themselves and their workers with the Authority.

There was a focus on culturally and linguistically diverse audiences in both campaigns, with communications material translated into ten languages for social media and multicultural publications. The translations were simplified and traditional Chinese, Sinhalese, Arabic, Korean, Italian, Vietnamese, Hindi, Punjabi and Spanish.

High value stakeholders including unions, employers and peak organisations were sent a ‘campaign stakeholder kit’ to give them the opportunity to distribute our campaign assets and messaging through their networks to workers covered by the Scheme.

Celebrating five years with local employers at Galkangu Bendigo GovHub

July 2024 marked the fifth year of operation of the Authority. To acknowledge this milestone, an event was held in August 2024 at our head office, located at Galkangu Bendigo GovHub.

The event was opened by Board Chair Julius Roe, and attended by the Honourable Maree Edwards, Speaker of the Victorian Legislative Assembly and the Member for Bendigo West. Also in attendance were representatives from the Bendigo Cleaning Company, central and northern Victoria disability services provider, Lifely and training provider ICAN Learn, a division of the Indigenous Consumer Assistance Network. These organisations are all local Bendigo employers registered with the Scheme.

Ms Edwards thanked the Authority and staff for their commitment to providing a better financial outcome for workers in the community services, contract cleaning and security industries who before the Scheme commenced in July 2019, often missed out on long service due to the tenuous nature of their jobs. Chief Executive Officer and Registrar Joseph Yeung concluded the event by highlighting that it was an honour to host the event and a great opportunity to meet and connect with local employers who show a vested interest in the future of their workforce by participating in the Scheme.

Implementing our Compliance and Enforcement Framework

| Achievements towards Performance Measures | Unit of Measure | 2026 Target | 2023-24 Actual | On-track |

| Quantity |

|

|

|

|

| Levies invoiced to the Authority within 60 Days of the end of each reporting period | % | 90% | 83%* | Yes |

| Completed compliance investigations within 12-month period (includes compliance activity and/or civil debtor activity) | Number | 80 per year | 80+ | Yes |

| Successful enforcement court actions | Number | 2+ | 10# | Yes |

* Based on the last quarter

# Comprising 3 default judgements in the Magistrate's Court of Victoria and 7 winding up applications in the Supreme Court of Victoria for employers who had failed to pay their levies.

The Authority is on track implementing our compliance and enforcement framework. This focused strategic approach has seen the program evolve from an education-based to an intelligenceled stronger compliance approach based on risk.

To support this work there has been a significant investment in growth recruitment with the establishment of two new teams: Employer Regulation and Investigations. With the new teams onboarded, focus shifted to operationalising the compliance and enforcement framework. These teams conduct the Authority's field activity following advanced government investigation techniques and procedures. Some of the work performed by the team during the year included a co-ordinated operation targeting unregistered employers in the disability sector in Geelong.

The Authority’s civil debt recovery work in the Magistrates Court of Victoria and Supreme Court of Victoria targets employers who fail to pay their levies.

In 2024-25, a community services employer with over 180 workers who failed to pay levies over an extended period was wound up in insolvency and placed into liquidation.

Another example includes a security and cleaning company, employing nearly 200 mostly casual workers, who after ceasing complying with its levy and quarterly return obligations, the Authority filed a winding up application, which led to the employer making payment in full and the Authority recovering all outstanding amounts as well as legal costs. This employer is now up to date on its outstanding quarterly returns, ensuring workers have correctly recorded service hours and accurate portable long service leave entitlements.

Lastly, the Authority is on track to meet the first target to continue to reduce the number of days to issue invoices towards the 60-day target by 2026. This has been supported by further resourcing the team and consultation with employer peak bodies which led us to simplify the reporting of hours and ordinary pay in quarterly returns to reduce the reporting impost on employers.

Targeting strategic enforcement in Geelong

Recognising the critical role of compliance in preserving the integrity of the Scheme, the Authority launched a targeted strategy to identify non-compliant employers within the disability services sector.

In its first coordinated education and compliance initiative, the Authority focused on disability service providers based in Geelong. The operation leveraged a multi-disciplinary approach, drawing on expertise from the Customer Service, Communications, Legal, Project Management and Investigations teams.

Geelong, home to the National Disability Insurance Agency headquarters, has a high concentration of disability providers. The pilot was designed to deepen the Authority’s understanding of the size and scope of the disability sector, which falls under the broader category of community services.

There were 3 phases of the pilot:

1. Desktop identification of potentially non-compliant employers

2. Stakeholder engagement via participation in the 2025 Geelong Disability Expo

3. Fieldwork conducted across the Geelong region.

The desktop review was undertaken as part of our program of work to identify covered employers who have not registered with the Authority and to conduct direct outreach with those employers to facilitate their registration.

At the expo, Authority staff interacted with over 100 workers and employers, with approximately 1,500 people attending the two-day event. The Authority also engaged in follow up outreach with employers who had sought further information regarding their obligations and those that were identified as not registered with the Scheme.

After the expo, our newly established Investigations team conducted a two-day blitz in the Geelong central business district to identify unregistered disability providers. This fieldwork was a significant step in the Authority’s evolving investigations and enforcement function. Arising out of the outreach and engagement with employers and the fieldwork, the Authority is now investigating a number of employers for non-compliance with their obligations.

Strategic communication activities supported the pilot, with targeted media releases distributed through local Geelong outlets and coordinated social media engagement.

Insights gained from the pilot will lay the foundation for future enforcement strategies.

Evolve baseline infrastructure to better practice systems and processes across the Scheme

| Achievement towards Performance Measure | Unit of Measure | 2026 Target | 2024-25 Actual | On-track |

| Quantity |

|

|

|

|

| Target Funding Ratio | % | 110% | 116% | Yes |

| Portable Long Service Benefits Claims Readiness | % | Ready | On-Track | Yes |

| VPS People Matter Survey Participation Rate | % | 85% | 100% | Yes |

As the Scheme grows so do the demands on the Authority’s workforce, systems and processes. During the 2024-25 financial year, there were 30,385 total calls through the Customer Service contact centre. 15,053 inbound calls and 15,332 outbound calls, with the average wait time to answer calls increasing from 13 seconds to 19 seconds. (NB. Revised 2023-24 figure).

Over $180 million was processed and collected by the Authority during the 2024-25 financial year. This represents 9% growth on the previous year, predominately due to the increase in registrations of both worker and employers with the Scheme. Total collections continue to be invested in accordance with the Authority’s investment strategy as set out by the Governing Board. This ensures that entitlements of registered workers are managed prudently while the sustainability of the Scheme has also been reviewed by the Authority’s appointed independent actuary in the current year. Investment performance of collected funds reported a return of 11.5% for the 2024-25 financial year. This has increased the funding ratio (for all three industries in total) to 116% (Community Services 115%, Contract Cleaning 124%, Security 118%), remaining on-track to surpass the target of 110% by 2026.

In addition to prudent financial management, our staff are central to the successful evolution of the Scheme. Several new teams were established in preparation for workers claiming portable long service benefits in 2026 and to support our compliance and enforcement strategy. In addition, key areas of focus for the People and Culture team were occupational health and safety and supporting a diverse and inclusive workplace. The Authority reported a 100% participation rate in the VPS People Matter Survey. Improvements included 93% of our staff understanding their personal contribution towards achieving our organisational goals. Consistent with other VPS entities, the results of our People Matter Survey are published on the Victorian Public Sector Commission’s website.

The key performance measure for the Authority is our readiness to pay portable long service benefits to workers. Improvements have been made to ensure greater efficiency of internal systems and simplified processes for employers. As managed funds have grown to over $700 million in financial assets, safeguarding data from unauthorised access and malicious threats is a core focus for the Authority.

Empowering women in leadership across the Authority

As part of our ongoing commitment to building an inclusive and diverse workplace, the Authority launched its inaugural Women in Leadership Program. It was an initiative born from the People and Culture strategic priority to amplify voices across the organisation. This program was designed to support emerging female leaders and create a space where leadership potential could flourish.

From February to May 2025, 12 participants across various business units embarked on a comprehensive leadership journey. Partnering with the Victorian Chamber of Commerce and Industry, the program involved personal coaching, professional workshops and peer collaboration.

The structured four-month experience opened with a 360-feedback review and one-on-one coaching sessions, followed by three full-day workshops and a half-day virtual workshop. Themes ranged from personal leadership style and skill development to resilience-building and balancing work-life demands. The program also focused on coaching techniques and presentation skills to help participants grow with confidence.

Building our information technology roadmap to support worker claims readiness

During 2024–25, the Authority undertook wide ranging IT, systems and project management transformation to improve service delivery, operational security and strategic readiness.

One of the most notable achievements was being among the first Victorian Government agencies to implement the recently launched Modern Desktop initiative. Modern Desktop runs on the latest operating system, powered by Windows 11 and Microsoft Intune.

The Authority continued our focus on cyber security with regular penetration testing, phishing simulations and awareness program to further our cyber resilience. We also commenced the implementation of Governance, Risk and Compliance software to streamline and strengthen the management of our Protective Data Security Plan and reporting obligations.

The Facilities and IT team introduced a new Service Desk system which will greatly improve the organisations workflows. The service desk enables robust incident management, categorisation and escalation, allowing in-depth root cause analysis and facilitating the development of targeted fixes.

We commenced development of a data warehouse which will improve our reporting and analytics capabilities. Complementing these efforts, an Information and Communication Technology roadmap was developed to guide future planning and technology investment decisions.

Throughout the year, the Project Management Office maintained its governance role across priority initiatives and continued to build capability within teams.

Significant advancements were also made in records and information management with the commencement of our new Information Architecture design and migration of legacy data to new document libraries.

To ensure we are prepared for claims processing from July 2026, we continued to focus on business process mapping and applying Lean Six Sigma principles to drive process optimisation under a continuous improvement mindset.

Financial Performance

Five-year financial summary

Five full years of comparative financial information is shown below.

| Authority five-year financial summary | ($’000) | ||||

| Summary | 2024-25 | 2023-24 | 2022-23 | 2021-22 | 2020-21 |

| Total income from transactions | 262,157 | 203,363 | 146,853 | 98,166 | 101,833 |

| Total expenses from transactions | 188,038 | 176,723 | 129,384 | 101,023 | 95,643 |

| Net result for the period | 74,199 | 26,640 | 17,469 | (2,857) | 6,190 |

| Net cash flow from operating activities | 151,227 | 145,867 | 115,390 | 95,420 | 75,929 |

| Total assets | 801,810 | 565,553 | 382,806 | 244,106 | 154,187 |

| Total liabilities | 669,993 | 507,855 | 351,748 | 230,517 | 137,741 |

| Net assets | 131,817 | 57,698 | 31,058 | 13,589 | 16,446 |

Current year financial summary

The Authority administers a Scheme that provides portability of long service leave benefits for registered workers in the community services, contract cleaning and security industries in Victoria.

The Authority levies registered employers for workers in the covered sectors and industries in accordance with the LSBP Act and the Long Service Benefits Portability Regulations 2020 (Vic) and makes payments for benefits taken.

In the 2024-25 financial year, the Authority’s net result was $74.1 million compared to $26.6 million in 2023-24. The major performance drivers in the current year’s net result were levy contributions of $196.2 million from employers (2023-24: $165.8 million) and total returns from investments held by the Authority of $64.6 million (2023-24: $36.4 million), offset by an increase in the portable long service benefits liability of $173.7 million (2023- 24: $166.1 million). The increase in the portable long service benefits liability is consistent with the growth of the Scheme and reflects the increased expectation as measured by the Authority’s appointed Scheme Actuary that more workers will now be eligible for future portable long service leave entitlements.

Levy contributions from employers and contractors are based on levy rates set by the Governing Board and this was the largest source of income from transactions. Levy contributions increased by $30.3 million in the current financial year due to the increase in registered workers. There are now over 400,000 workers registered in schemes across the three covered sectors and industries.

During the financial year, the Authority transferred $183 million to the VFMC Balanced Fund, Victorian Funds Management Corporation (VFMC) increasing total investments held with VFMC to $712.6 million.

The portable long service benefit expense for 2024-25 is $173.7 million, representing an increase in the benefits liability for workers of $7.6 million ($45.4 million 2023-24). Administration costs totalled $13.7 million with $9.4 million relating to employee benefits expense of the Authority and its regulatory operations and $4.3 million for information technology costs, office expenses, professional services, promotion costs along with internal and external audit fees.

Financial position balance sheet

The Authority’s net asset position at 30 June 2025 was $131.8 million and the funding ratio of all 3 portable long service leave schemes was 116.4%.

Cash at bank totalled $29.5 million, which includes mainly Scheme funds collected and not transferred to VFMC investments as at 30 June 2025.

The Authority increased its investments with the VFMC to $658.6 million and accrued $54 million representing an investment distribution due from the VFMC that was paid in July 2025.

Operating cash flows

Net cash flow from operating activities was positive for the year totalling $151.2 million, which included $179.8 million of receipts from employers for their worker levy contributions.

The Authority transferred $183 million to the VFMC Balanced Fund and received $32.3 million of investment distributions during the financial year.

Investment performance

The Governing Board has approved an investment strategy based on an analysis of desired investment returns against investment risk appetite.

The investment objectives of the Authority at 30 June 2025 are:

- Return: To achieve an average return objective of at least CPI + 3.0% p.a. with greater than 60% probability over a rolling 10-year period; and

- Risk: To limit the likelihood of a negative annual return to no more than one year in every five years, and when negative returns occur not to exceed a 10% loss of capital.

The Authority exceeded its investment return objective of CPI + 3.0% p.a. with a return of 11.48% for the 2024-25 financial year.

Current year investment performance

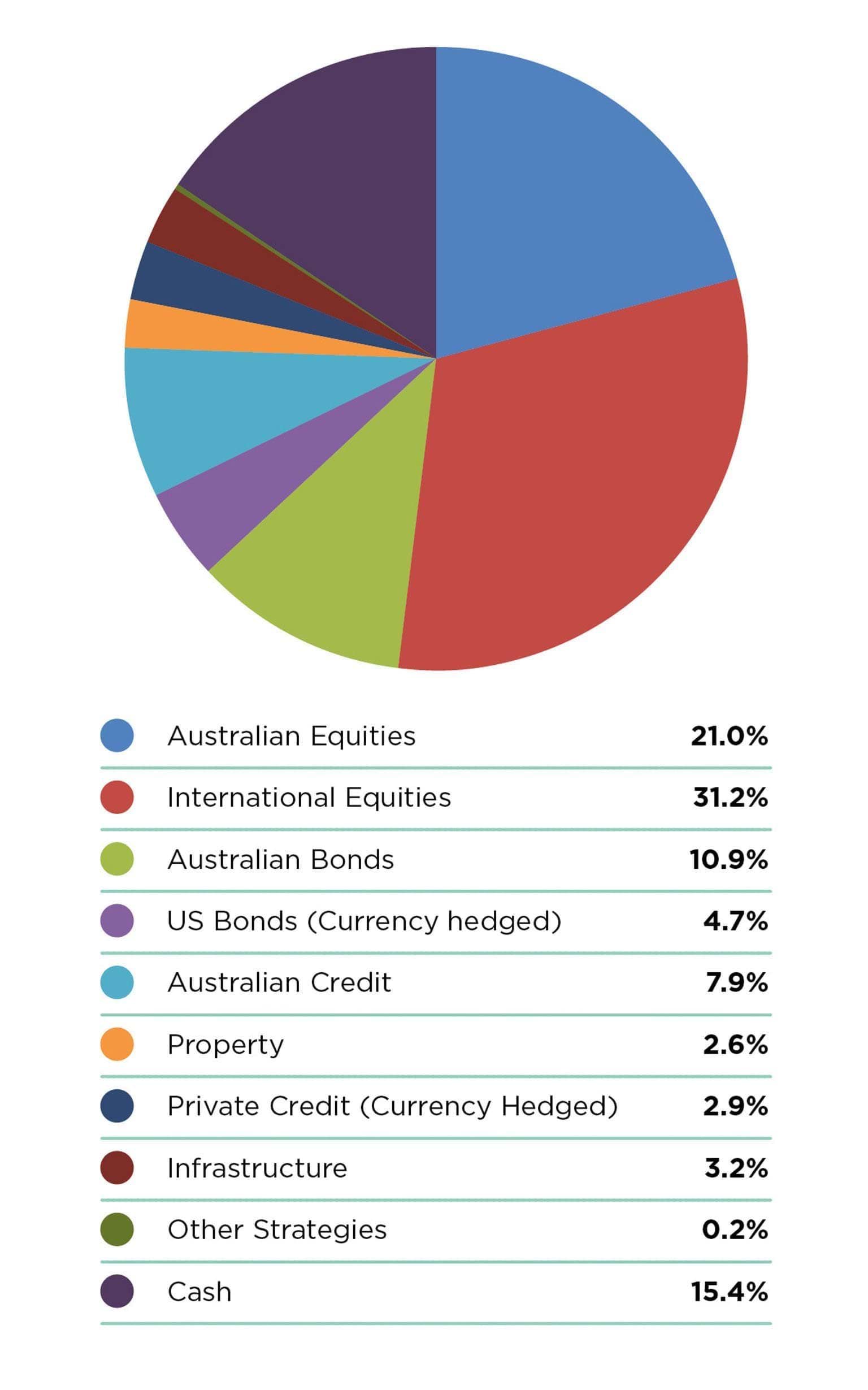

Under the Act, the Authority is permitted to invest Scheme assets for the benefit of the schemes. The Authority has appointed VFMC as its investment manager and VFMC has determined the following balanced asset allocation of investments for the Authority’s portfolio:

For the 12 months from 1 July 2024 – 30 June 2025, the Authority recorded a gain on fair value of investments of $1.6 million against total Scheme funds of $658.6 million at 30 June 2025. The Authority also received $32.3 million of investment distribution during the year.

Outlook

The Authority is continually working with its investment manager to adjust portfolio positioning in response to market movements and changes to economic conditions and policy outlook of governments, which may affect key investment asset classes.

Other Disclosures

Other disclosures for the financial year 2024-25.

Local jobs first

The Local Jobs First Act 2003 (Vic), introduced in August 2018, brings together the Victorian Industry Participation Policy and Major Project Skills Guarantee, which were previously administered separately.

The Authority is required to apply the Local Jobs First policy to all metropolitan Melbourne or statewide projects valued at $3 million or more, or any regional Victoria projects valued at $1 million or more.

The Authority undertook no projects subject to the Local Jobs First policy during the 2024-25 reporting period.

Government advertising expenditure

In 2024-25 there were no government advertising campaigns of $100,000 or greater (exclusive of GST).

Consultancy expenditure

Details of consultancies (valued at $10,000 or greater)

In 2024-25, there were four consultancies where the total fees payable to the consultants were $10,000 or greater. The total expenditure incurred during 2024-25 in relation to these consultancies was $0.11 million (excluding GST). Details of individual consultancies are outlined below.

| Consultant | Purpose of consultancy | Start date | End date | Total approved project fee (excl. GST) $'000 | Expenditure 2024-25 (excl. GST) $'000 | Future Expenditure (excl. GST) $'000 |

| Deloitte Consulting Pty Ltd | Valuation Services | 18 May 2024 | 31 Jul 2024 | $55 | $49 | $- |

| Deloitte Consulting Pty Ltd | Valuation Services | 1 May 2025 | 31 Jul 2025 | $51 | $- | $51 |

| Deloitte Consulting Pty Ltd | Actuarial Services - 3 Year Levy Review | 17 Oct 2023 | 30 Jun 2024 | $226 | $44 | $ - |

| Brooke Institute Pty Ltd | Advisory Services | 24 Apr 2024 | 30 Sep 2025 | $256 | $19 | $150 |

Details of consultancies under $10,000

In 2024-25 there was no consultancy engaged during the year, where the total fees payable to the individual consultancy was less than $10,000 (exclusive of GST).

Review and studies expenditure

Details of reviews and studies

During 2024-25 one review was undertaken with the total cost of $44,800. Details of the review are outlined below.

| Name of the review | Reasons for review/study | Terms of reference/ scope | Anticipated outcomes | Estimated cost for the year (excl. GST) $'000 | Final cost if completed (excl. GST) $'000 | Publicly available (Y/N) and URL $'000 |

| Tax Review | To determine if the Authority is complying with all relevant tax rules and regulations | Review of income tax, tax impact on investment income, withholding tax codes for worker claims payments, employment related taxes (payroll and FBT), Goods & Services Tax | A high level report documenting findings and recommendations | $45 | $45 | No |

Information and communication technology expenditure

Details of information and communication technology (ICT) expenditure

For the 2024-25 reporting period, the Authority had a total ICT expenditure of $1.74 million, with details shown below.

| All operational ICT expenditure | ICT expenditure related to projects to create or enhance ICT capabilities | ||

| Business as Usual (BAU) ICT expenditure $'000 | Non-Business as Usual (non-BAU) ICT expenditure $'000 | Operational expenditure $'000 | Capital expenditure $'000 |

| (Total) | (Total = Operational expenditure and capital expenditure) | ||

$1,302 | $436 | $436 | - |

ICT expenditure refers to the Authority’s costs in providing business enabling ICT services within the current reporting period. It comprises Business as Usual (BAU) ICT expenditure and Non-Business as Usual (Non-BAU) ICT expenditure. Non-BAU ICT expenditure relates to extending or enhancing the Authority’s current ICT capabilities.

BAU ICT expenditure is all remaining ICT expenditure that primarily relates to ongoing activities to operate and maintain the current ICT capability.

Disclosure of major contracts

The Authority did not award any major contracts valued above $10 million or more during 2024-25.

Freedom of Information

The Freedom of Information Act 1982 (Vic) (the FOI Act) allows the public a right of access to documents held by the Authority.

Information about the type of material produced by the Authority is available on its website under the Part II Information Statement.

During the 2024-25 financial year, the Authority did not receive any Freedom of Information requests.

During the 2024-25 financial year, no requests were subject to a complaint/internal review by Office of the Victorian Information Commissioner or were progressed to the Victorian Civil and Administrative Tribunal.

Making a request

Access to documents can be made by a written request to the Authority’s Freedom of Information Officer as detailed in section 9 of the FOI Act. The 2024-25 application fee was $32.70.

When making a Freedom of Information request, applicants should ensure requests are in writing and clearly identify the documents being sought.

Requests for documents in possession of the Authority can be made via email to foi@plsa.vic.gov.au(opens in a new window) or by mail to:

Attention: Freedom of Information Officer

Portable Long Service Authority

PO Box 443

Bendigo VIC 3552

Further Information

Access charges may also apply once documents have been processed and a decision on access is made, such as but not limited to photocopying, search and retrieval charges. Further information regarding Freedom of Information can be found at ovic.vic.gov.au/freedom-of-information/(opens in a new window).

Compliance with the Building Act 1993 (Vic)

The Authority does not own or control any government buildings and consequently is exempt from notifying its compliance with the building and maintenance provisions of the Building Act 1993 (Vic).

The Authority met all relevant compliance provisions of the Building Act 1993 (Vic) in our building and maintenance activities during the year.

Competitive neutrality policy

The Authority does not provide services that compete with the private sector and is therefore not subject to the requirements of the National Competitive Policy (NCP) including compliance with the requirements of the Neutrality Policy Victoria or any subsequent reforms.

Public Interest Disclosures

The Public Interest Disclosures Act 2012 (Vic) (the PID Act) encourages and assists people in making disclosures of improper conduct by public officers and public bodies. The PID Act provides protection to people who make disclosures in accordance with the PID and establishes a system for the matters disclosed to be investigated.

The Authority encourages its officers and members of the public to report known or suspected incidences of improper conduct and detrimental action.

Disclosures of improper conduct or detrimental action by the Authority or any of its employees and/or officers must be made directly to the Independent Broad-based Anti-corruption Commission:

Level 1, North Tower, 459 Collins Street

Melbourne, VIC 3000

Phone: 1300 735 135

www.ibac.vic.gov.au

Disclosures under the Public Interest Disclosures Act 2012 (Vic)

| 2024-25 number | |

| The number of disclosures made by an individual to the authority and notified to the Independent Broad-based Anti-corruption Commission | - |

| Assessable disclosures | - |

Compliance with the Carers Recognition Act 2012 (Vic)

To the extent applicable, the Authority has taken all practical measures to comply with obligations under the Carers Recognition Act 2012 (Vic) (the CR Act). These include:

- ensuring our staff have an awareness and understanding of the care relationship principles set out in the CR Act.

- considering the care relationships principles set out in the CR Act when setting policies and providing services.

- promoting the availability of flexible work arrangements and providing resources to effectively support this.

- providing support to all staff through the Employee Assistance Program.

Compliance with the Disability Act 2006 (Vic)

The Authority acknowledges the importance of strengthening the rights of people with a disability. We are committed to creating and maintaining an accessible and inclusive environment for all people with a disability who come into contact with the Authority, whether as employees, stakeholders or members of the public more generally. The Department of Premier and Cabinet developed a comprehensive Disability Access and Inclusion Plan 2021-25 which informs the Authority’s policies ensuring we remain responsive to the needs of people with a disability.

Procurement complaints

Under the Governance Policy of the Victorian Government Purchasing Board, the Authority must disclose any formal complaints relating to the procurement of goods and services received through its procurement complaints management system.

The Authority received no formal complaints through its procurement complaints management system in 2024-25.

Transportation

The Authority’s fleet is comprised of 2 passenger vehicles. These vehicles are essential to the operation of the Authority, for example, travel relating to the Authority’s compliance and enforcement activities.

Sustainable buildings and infrastructure

The Authority’s two offices, in Bendigo and Melbourne, maximise natural light, with electronics, lighting, heating and cooling switched off each evening.

The Galkangu Bendigo GovHub is Victoria's largest timber frame office. Its environmentally sustainable design contains efficient indoor air quality systems, solar panels, water and energy monitoring systems.

The Victorian Government’s Digital First principles are applied with staff encouraged to avoid printing where possible. Senior staff members have been provided with portable devices to assist with this initiative. In addition, the Authority utilises “Follow Me” printing which enables usage reporting, application of print policies organisation-wide and mobile printing solutions to reduce waste, saving on average 30% of wasted print jobs sent in error.

All office waste systems across our two locations are segregated, reducing the amount of recyclable material directed to landfill.

Authority staff are strongly encouraged to adopt “green commuting” through active or public transport when undertaking business activities, particularly when travelling between our Bendigo and Melbourne locations. Meetings are also conducted via video conferencing where possible to reduce unnecessary or excessive travel.

The Authority has phased out single-use plastics in its offices. This is in line with the Authority’s recognition of the importance of reducing our environmental footprint.

Agency Specific Legislative Disclosures

Subsequent events

There are no post balance date events that materially affect the Authority’s 2024-25 financial statements.

Additional information

The Authority’s published reports and documents are available online at plsa.vic.gov.au.

Any relevant information in relation to the financial year is retained by the Accountable Officer and is available on request subject to the provisions of the FOI Act.

Attestation for financial management compliance with Standing Directions 5.1.4

Contains the Asset Management Accountability Framework (AMAF)

Portable Long Service Benefits Authority Financial Management Compliance Attestation Statement

I, Julius Roe, on behalf of the Responsible Body, certify that the Portable Long Service Benefits Authority has no Material Compliance Deficiency with respect to the applicable Standing Directions under the Financial Management Act 1994 (Vic) and Instructions.

Julius Roe

Chair, Governing Board

Portable Long Service Benefits Authority

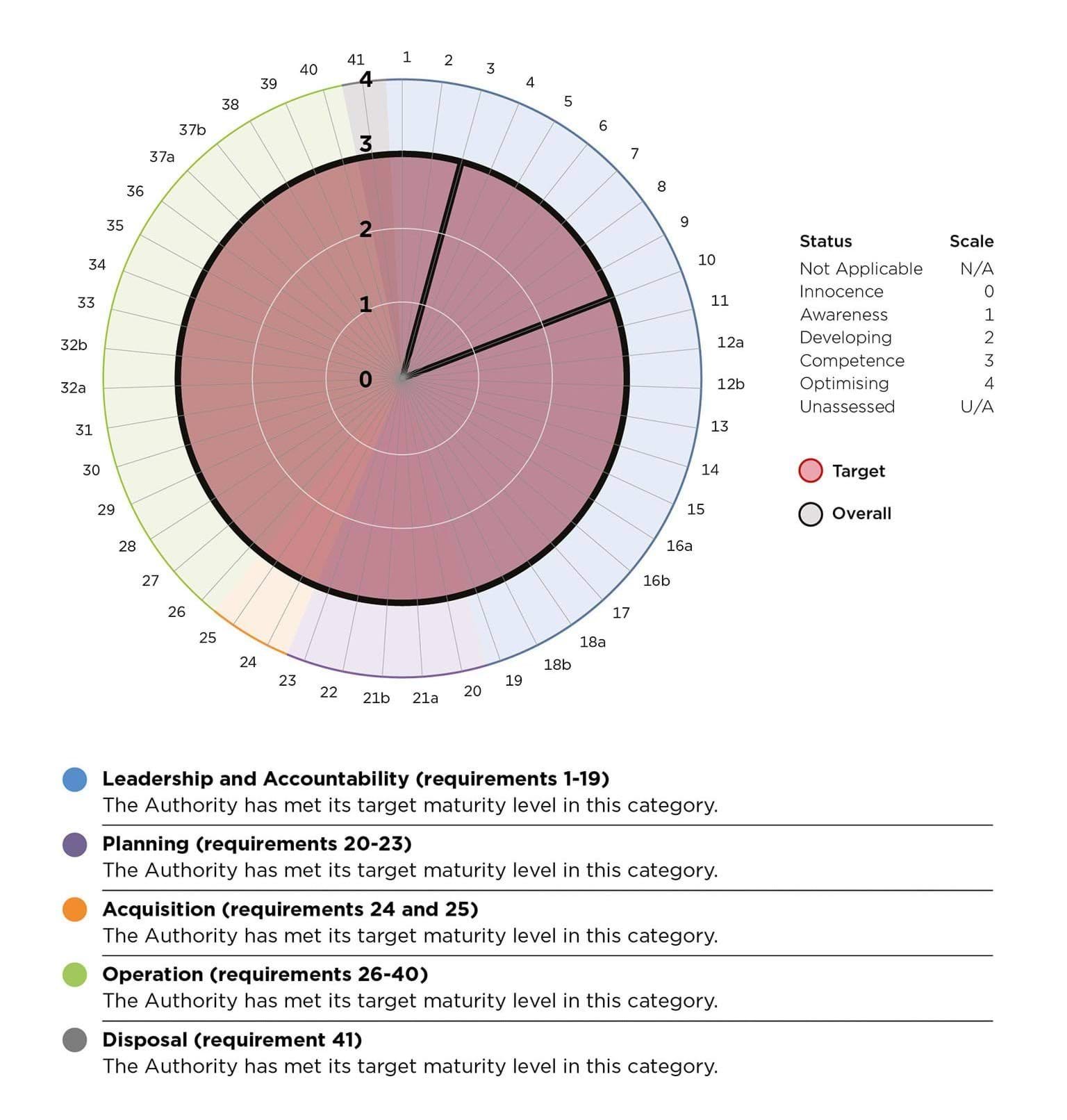

Asset Management Accountability Framework maturity assessment

The following sections summarise the Authority’s assessment of maturity against the requirements of the Asset Management Accountability Framework (AMAF). The AMAF is a non-prescriptive, devolved accountability model of asset management that requires compliance with 41 mandatory requirements. These requirements can be found on the Department of Treasury and Finance website (dtf.vic.gov.au)(opens in a new window).

The Authority’s target maturity rating is ‘competence’, meaning systems and processes are fully in place, consistently applied and systematically meet the AMAF requirement, including a continuous improvement process to expand system performance above AMAF minimum requirements.

The Authority has assessed requirements 3 and 10 as not applicable.

Leadership and Accountability (requirements 1-19)

The Authority has met its target maturity level in this category.

Planning (requirements 20-23)

The Authority has met its target maturity level in this category.

Acquisition (requirements 24 and 25)

The Authority has met its target maturity level in this category.

Operation (requirements 26-40)

The Authority has met its target maturity level in this category.

Disposal (requirement 41)

The Authority has met its target maturity level in this category.

Financial Statements

Financial statements for the financial year ended 30 June 2025.

Understanding the financial statements

Comprehensive Operating Statement

The Comprehensive Operating Statement measures our performance over the year and shows if a surplus or deficit has been made in delivering our services. The statement includes all sources of income less all expenses incurred in earning that income.

For the financial year ending 30 June 2025, the net gain of the Authority was $74.1 million.

Balance Sheet

The Balance Sheet sets out our net accumulated financial worth at the end of the financial year. It shows the assets we own as well as liabilities or claims against those assets. Both assets and liabilities are expressed as current or non-current. Current assets or current liabilities are expected to be converted to cash receipts or outlays within the next twelve months. Noncurrent assets or liabilities are longer-term. Equity is our reserves and accumulated surplus that have been reinvested in the Authority over the year. For the year ending 30 June 2025, the Authority had net assets of $131.8 million.

Cash Flow Statement

The Cash Flow Statement summarises our cash receipts and payments for the financial year and the net cash position at the end of the year. It differs from the Comprehensive Operating Statement in that it excludes non-cash expenses such as the accruals taken into account in the Comprehensive Operating Statement. For the year ending 30 June 2025, the Authority had net cash flow from operating activities of $151.2 million.

Statement of Changes in Equity

The Statement of Changes in Equity shows the changes in equity from last year to this year. The total overall change in equity during a financial year comprises the net result for the year.

Notes to the Financial Statements

The Notes to the Financial Statements provide further information about how the financial statements are prepared as well as additional information and detail about specific items within them. The Notes to the Accounts also describe any changes to accounting standards, policy or legislation that may affect the way the statements are prepared.

Information in the Notes is particularly helpful if there has been a significant change from the previous year’s comparative figures.

Statutory Certificate and VAGO Independent Auditor's Report

These provide the reader with a written undertaking that the financial statements fairly represent the Authority’s financial position and performance for 2024-25. The Report from the Independent Auditor provides an independent view and outlines any issues of concern.

Statutory Certification

The attached financial statements for the Portable Long Service Benefits Authority (the Authority) have been prepared in accordance with Direction 5.2 of the Standing Directions of the Minister for Finance under the Financial Management Act 1994, applicable Financial Reporting Directions, Australian Accounting Standards including interpretations, and other mandatory professional reporting requirements.

We further state that, in our opinion, the information set out in the Comprehensive Operating Statement, Balance Sheet, Cash Flow Statement, Statement of Changes in Equity and the accompanying notes, presents fairly the financial transactions during the financial year ended 30 June 2025 and the financial position of the Authority as at 30 June 2025.

At the date of signing, we are not aware of any circumstance which would render any particulars included in the financial statements to be misleading or inaccurate.

We authorise the attached financial statements for issue on 9 September 2025.

Julius Roe

Chair

Portable Long Service Benefits Authority

Joseph Yeung

Chief Executive Officer and Registrar

Portable Long Service Benefits Authority

Andrew Hosking

Chief Financial Officer

Portable Long Service Benefits Authority

VAGO Independent Auditor's Report

Comprehensive operating statement

For the financial year ended 30 June 2025

| Continuing operations | Notes | 2025 | 2024 |

| Income from transactions |

|

| |

| Contributions from employers and contractors | 2.2.1 | 196,178 | 165,846 |

| Investment distribution | 2.2.2 | 62,989 | 27,049 |

| Interest | 1,379 | 1,071 | |

| Net gain on fair value of investments | 4.2.1 | 1,611 | 9,397 |

| Total income from transactions | 262,157 | 203,363 | |

| Expenses from transactions |

|

| |

| Employee benefits expense | 3.3.1 | (9,405) | (6,838) |

| Portable long service benefits expense | 3.4.1 | (173,734) | (166,122) |

| Administration expense | 3.2 | (4,261) | (3,725) |

| Interest expense | 6.2.2 | (188) | (2) |

| Depreciation | 4.1.2 | (450) | (36) |

| Total expenses from transactions | (188,038) | (176,723) | |

| Net result from transactions (net operating balance) | 74,119 | 26,640 | |

| Net result | 74,119 | 26,640 | |

| Comprehensive result | 74,119 | 26,640 |

The accompanying notes form part of these financial statements.

Notes: (a) This format is aligned to AASB 1049 Whole of Government and General Government Sector Financial Reporting.

Balance sheet

As at 30 June 2025

| Notes | 2025 | 2024 | |

| Assets |

|

| |

| Current assets |

|

| |

| Cash and deposits | 6.3 | 29,472 | 29,220 |

| Receivables | 5.1 | 110,077 | 62,095 |

| Investments and other financial assets | 4.2 | 101,423 | 62,560 |

| Prepayments | 158 | 148 | |

| Total current assets | 241,130 | 154,023 | |

| Non-current assets |

|

| |

| Property, plant and equipment | 4.1 | 3,516 | 151 |

| Investments and other financial assets | 4.2 | 557,164 | 411,379 |

| Total non-current assets | 560,680 | 411,530 | |

| Total assets | 801,810 | 565,553 | |

| Liabilities |

|

| |

| Current liabilities |

|

| |

| Payables | 5.2 | 1,699 | 914 |

| Employee benefits | 3.3.2 | 844 | 667 |

| Accrued portable long service benefits | 3.4.2 | 53,980 | 31,652 |

| Borrowings | 6.1 | 357 | 66 |

| Total current liabilities | 56,880 | 33,299 | |

| Non-current liabilities |

|

| |

| Employee benefits | 3.3.2 | 284 | 212 |

| Accrued portable long service benefits | 3.4.2 | 609,491 | 474,259 |

| Borrowings | 6.1 | 3,338 | 85 |

| Total non-current liabilities | 613,113 | 474,556 | |

| Total liabilities | 669,993 | 507,855 | |

| Net assets | 131,817 | 57,698 | |

| Equity |

|

| |

| Reserves | 6.5 | 6,818 | 6,818 |

| Accumulated surplus | 124,999 | 50,880 | |

| Net worth | 131,817 | 57,698 |

The accompanying notes form part of these financial statements.

Notes: (a) This format is aligned to AASB 1049 Whole of Government and General Government Sector Financial Reporting.

Cash flow statement

For the financial year ended 30 June 2025

| Notes | 2025 | 2024 | |

| Cash Flows from Operating Activities |

|

| |

| Receipts |

|

| |

| Receipts from Victorian Government for Community Health Centres | - | 3,419 | |